The Grogan Agency

When managing a business in Alabama, protecting your equipment from unexpected breakdowns is crucial. At The Grogan Agency, we understand the unique challenges faced by businesses in our state. Equipment breakdown insurance can help provide peace of mind when your essential machinery or technology encounters issues.

What Is Equipment Breakdown Insurance?

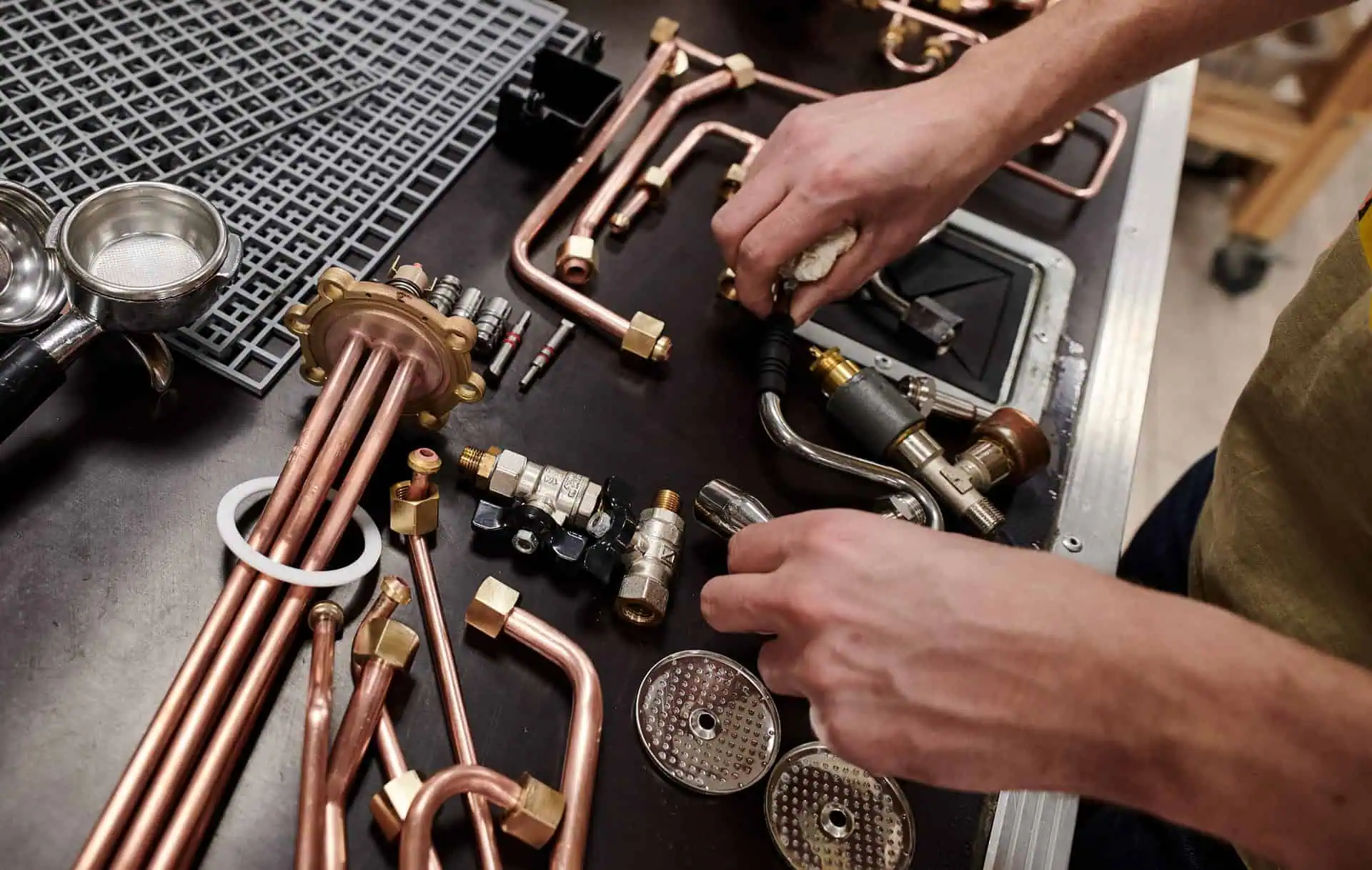

Equipment breakdown insurance is a specialized type of coverage designed to help businesses recover from the costs associated with the failure or malfunction of critical equipment. This can include mechanical breakdowns, electrical failures, or other sudden damages that disrupt your operations.

Unlike traditional property insurance, equipment breakdown coverage often focuses on the repair or replacement of the equipment itself, as well as related expenses like business interruption and additional costs resulting from the breakdown.

Why Might Businesses in Alabama Need Equipment Breakdown Coverage?

In Alabama, various industries rely heavily on specialized equipment—from manufacturing and healthcare to food services and technology. Equipment breakdowns can lead to costly repairs, lost productivity, and potential income loss.

Given Alabama’s climate and business landscape, equipment can face unique stresses, including high humidity, power surges, or wear from frequent use. Equipment breakdown insurance can be a helpful tool to manage the financial impact when unexpected issues arise.

How Do You Get Started With Equipment Breakdown Insurance In Alabama?

Starting with The Grogan Agency is straightforward. We begin by learning about your business, equipment, and potential exposures. Then, we explore coverage options that might include equipment breakdown insurance tailored for Alabama businesses.

Our local expertise helps ensure that coverage choices consider both your industry-specific risks and regional factors. Reach out to us for a consultation to better understand how this coverage might benefit your company.

Get a Quote

Share your details with us, and our team of friendly agents will be in touch with you soon!